In conjunction with UCLA’s Technology Development Group and Amgen Ventures & Business Development in LA, this is a video of a panel discussion on the biotech industry. It is moderated by Rajit Malhotra, Executive Chairman of Dyve Biosciences and TDG Board Member.

Category Archives: Economy

Businesses Coming Back!

Thankfully businesses and companies are being allowed to re-open. A week and a half ago, the safety protocols that had long been in play due to COVID-19, were “retired” by Cal/OSHA, following CDC and California Department of Health most recent guidelines.

In related news, some other companies are showing signs of returning to life by creating a presence int eh region. Apple® will be opening up a new retail store in downtown LA at the historic Tower Theatre. The company also launched an international initiative providing hands-on experience and mentorship to youngsters with the opening of their new store. According to Senior VP of Retail + People at Apple, Deirdre O’Brien:

“At every corner, Los Angeles bursts with creativity across the arts, music, and entertainment, and we are thrilled to build on our relationship with this special city. Apple Tower Theatre honors the rich history and legacy of this entertainment capital.”

Let’s hope this is the beginning of LA springing back to life, especially in the entertainment industry which has been hardest hit by the coronavirus pandemic.

California’s Economic Growth Forecast

As the pandemic starts to recede, predictions for California’s economic growth are starting to look good. According to the UCLA Anderson Forecast of 2021, “near record growth” is expected with the vaccinations. While “in California, recovery may come later [it] should ultimately be faster than rest of U.S.” This in part has been explained by what California did during the pandemic, imposing more laws such as masks, closures, etc. than other states. UCLA’s Jerry Nickelsburg explains:

“Although the timing may be offset with California beginning a significant recovery later than some other states, we expect the California recovery to ultimately be, once again, faster than the U.S. The more rapid growth we forecast for the U.S. economy — in light of how mass vaccinations have affected pandemic restrictions on economic activity, and taking into account the new stimulus package from Washington — will also lead to a more optimistic California forecast than in December.”

Of course – not unlike other US states – it will be the hospitality and leisure industries that will take the longest to bounce back. This is for two reasons: lack of tourism and the fact that they were hit hardest from the pandemic. But with business, science and tech industries, the recovery will be faster and stronger. This is also due to the fact that there has been a significant increase in the need and desire for new technologies to support the new way of working and indeed living.

Vis-à-vis California’s unemployment numbers Q1 2021 is likely to be at 7.7 percent with a drop in 2022 to 5.1 percent and 2023 to 4.1 percent.

Another factor to be taken into consideration is the impact of California’s 2021-22 budget. More funding than is possible is needed for public health and education, which will mean low-income Californians will lag in recovering economically. The key here is therefore an investment in economic growth drivers which include closing tax loopholes and bolstering revenues over the next few years.

Underground Operations

As we know, many businesses have had to shutter due to the pandemic. In LA, the ‘Safer at Home’ order from Mayor Garcetti was thus violated. The ones most negatively impacted are the smaller stores. In an effort to prevent them from being completely destroyed, some of these companies – in the ‘non-essential’ category – have thus started ‘operating underground’ as it were in an effort to survive.

This has been dealt with by the law. LA City attorney Mike Feuer has charged many businesses with violation of the law. In response to why they broke the law, one company explained that their choice was either to risk “the fine or we can’t pay our mortgage.”

Of course these companies are trying to run their businesses with discretion. One of them confessed to meeting clients in a back alley while having a sign on their door saying ‘closed due to coronavirus.’ Another store owner said they have appointments only and when meeting with clients the shades are down and the lights are off.

However, there is more than just facing a fine. There is also the prospect of having utilities shut off for those not complying with the Safer at Home decree.

While small businesses have received some help from the government (the PPP from the Treasury Department for example) a lot of businesses claim this is too little too late. According to one local vendor:

“That amount of money came in and covered the costs of one month. With the PPP loan, you had eight weeks that you had to use those funds for payroll and utilities… It looked like I gave myself a big raise, but it just kept me afloat for those months that I was behind.”

A Yelp economic impact report has found 97,966 businesses have closed due to the pandemic.

Economic Recovery for Southern California

According to a meeting held at the beginning of this month, the economic recovery from COVID-19 is set to be “long and uneven” in the Southern Californian region. This was the conclusion of the annual Southern California Economic Summit held by the Southern California Association of Governments (SCAG).

Still, it’s not all doom and gloom. At the summit, Governor Gavin Newsom said:

“We’re going to be alright. In fact, not only be alright, there’s no state better positioned in the future than this state.”

There is however, work to be done. This involves the importance of home ownership expansion in 2021; investment in people-of-color-owned SMEs; bolstering education, pushing forward the manufacturing industry, etc.

Over in Long Beach, it is hoped that the City Council will approve the proposal for a $5m fund in support of personal care service providers (cosmetic stores, hair salons, tattoo parlors etc.). so far it already has the support of Al Austin, Rex Richardson and Robert Uranga from the Council. The money will come from the next federal stimulus package.

Local Coronavirus Updates: More Aid Available

There are often updates about extra financial aid being offered to businesses during the coronavirus pandemic. Still many SME owners feel they miss the boat on the efforts being made by local and federal entities.

As such, it is good to hear about how LA city and county have banded together to help. A $98 million grant program has been developed for those organizations and companies that have been left behind. Money will be given first to the firms that are based in low- moderate-income communities and/or owned by veterans or those whose gross revenue is less than $500,000.

Supervisor Mark Ridley-Thomas explained:

“Six thousand entities will be made better as a result of these resources — anywhere from $5,000 to $75,000 per entity.”

While the Los Angeles Regional COVID-19 Recovery Fund has to date awarded $3.2 million in grants to more than 300 enterprises, the additional money will hopefully really bring relief to entrepreneurs, small businesses and all others struggling. Monies will be given out anywhere in between $5,000 to $25,000.

In addition, Kathryn Burger, Los Angeles County Supervisor pointed out that:

“The COVID-19 pandemic has devastated communities across Los Angeles County with significant health and economic impacts. The L.A. Regional Recovery Fund is one of many efforts led by the county to help our residents and businesses get through these challenging times and emerge stronger than before.”

This is the city’s fourth round of relief.

More Relief for Small Business in LA

With the coronavirus still in full swing and so many individuals and communities continuing to suffer, any assistance that is offered is very welcome. Our Mayor – Eric Garcetti – just announced more funds to be put into the fiscal recovery program. He said:

“We are investing an additional $10 million this evening in funds for the LA Regional COVID-19 recovery program. This comes on top of an existing $3 million pot already dedicated to this initiative. We now will be able to offer grants, not loans, but grants to the small businesses and nonprofits that are the lifeblood of our economy. And this funding is designed specifically to assist out most vulnerable businesses who did not get served by our federal Paycheck Protection Program. Maybe because they’re underbanked, maybe because they didn’t have the staff, but we know too many small businesses, especially on our main streets, Black-owned businesses and immigrant-owned businesses, women-owned businesses and family-owned businesses were not helped enough.”

It is hoped that this aid will help more small business stay in operation and thus limit those losing their jobs.

To date, over $53.4m has been given to over 500 small businesses in loans thanks to the California Credit Union which has gotten the money through the SBA Paycheck Protection Program (PPP). It has been estimated that this money has managed to save (or repair) around 5,000 southern Californian jobs. According to Steve O’Connell, President and CEO of the California Credit Union:

“Small local businesses are the backbone of our economy, and the SBA program has been an absolute lifeline to help these businesses survive the pandemic. When the program launched, our team immediately jumped into action, working seven days a week to help them access these funds, which in many cases were the only option to keep their doors open, the lights on, and staff on payroll. To meet demand, we redeployed and trained staff from other credit union areas, who have worked around the clock to assist members and submit applications. We continue to receive letters and emails from local businesses thanking us for our help, which show us the real impact this program is having in supporting the financial health of our communities. As a preferred SBA lender, we’ve been committed to serving businesses in our communities since 2008 with our business banking services. We are fortunate to have the business banking expertise and infrastructure in place to rally our resources, move quickly to make the application live as soon as it was launched, and help our business members access the program in both rounds.”

For sure there are still many – too many – who have lost their jobs or businesses, but this is a start.

The Re-Opening of LA County

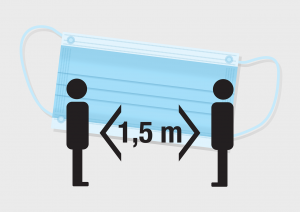

Two days ago it was announced that all LA County retailers will be permitted to re-open, within guidelines and approval from health officials – the same as those put in place for how Walmart has been permitted to operate during this time. this basically translates into: social distancing, the wearing of masks and limiting the amount of people in the store at any one time.

Janice Hahn, LA County Supervisor noted:

“I think it’s a real lifeline that has been thrown to our small businesses – at a time when many of them, frankly, were wondering whether or not they could make it.”

This new measure would not currently be extended to personal hygiene/cosmetic stores. However, houses of worship will be able to re-open. The laws have already received approval in Riverside County.

LA: Getting Back to Business

Policy makers in LA set out guidelines last week to help people get back to work. Gov. Gavin Newsom has announced that certain local businesses will be able to reopen if they have a low amount of cases of the novel coronavirus.

This will include local eateries and shopping malls so long as they are in line with the guidelines including social distancing, testing and disinfectant/cleaning laws. As well, pet groomers and car washing facilities will be able to re-open.

Californians whose jobs have been impacted by COVID-19 and not been able to work from home will be allowed to return to their offices on two conditions: their particular counties are considered safe and the offices in which they work are following all regulations.

The first seven counties that have met the regulations and will be permitted to reopen are: Amador, Butte, El Dorado, Lassen, Nevada, Placer and Shasta.

Helping ALL Californians

Undocumented immigrant workers in California will be the first to receive financial aid. Those who have not been able to get Pandemic Unemployment Assistance or are not eligible to collect unemployment insurance will be assisted in this way.

The value of this – according to a recent statement by Gov. Newsom – is $125m. $75m of that will be in the form of state funds for disaster relief assistance. A further $50m has been committed from charitable entities. As Newsom said:

“Even if there’s gaps, we can help begin to fill them. I’m not here to suggest that $125 million is enough. But I am here to suggest that it’s a good start and I’m very proud it’s starting here in the state of California. We feel a deep sense of gratitude for people that are in a fear of deportation but are still addressing the essential needs of tens of millions of Californians.”

What this means is that $500 will be given to around 150,000 undocumented Californians – $1,500 maximum for each household which is 10 percent of the entire workforce in the region.